Every once in a while, I do a personal finance post. This is not a frugality blog. It’s more like a “Mortgage-Free Couple Spends Every Penny of Their Dual Incomes” blog. I know I have readers who live on 15% of what we do, so you may want to skip this post!

Like everyone else who is comfortably-off, I scrimp on some areas and splurge on others.

The annual budget this year includes the replacement of our heating system, from savings (just completed) and three trips – two family visits and our first-ever trip to NYC, planned for October.

Image: systembuilthomes.ca

My current boiler is 84% efficient at its best. Fuel cost right now is $1.15/litre.

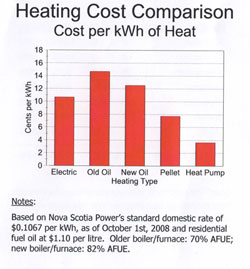

The new heat pump system will change our utility bills a lot since we will use oil only as a back-up when the outdoor temperature is below -15C, and when the units are defrosting. We have switched to electric-powered hot water so we won’t need to buy oil to heat water in the summer. The units also provide whole-house air conditioning! However, we used to have a dehumidifier on continuously for most of the summer, so I am interested to see the difference. The heat pumps are ridiculously energy-efficient compared to our oil boiler, so I am predicting a good year for utilities.

In my budget, there are several listings for household expenses: improvements (big projects), savings for repairs, spending on minor repairs, and “misc” which includes things like a couple of towels, or a new lock for the shed.

We budget $490/month for groceries which includes all food, a small amount of cleaning and paper products, and personal care items. If we have a meal out or go to a cafe, it’s put in the entertainment line.

The amount for gifts will pop out at you. I allocate $ to purchase major items for our adult child, Link, such as a laptop or a sewing machine, in lieu of birthday and holiday gifts. Otherwise we are just spendy when it comes to gifts. We don’t need much so I would rather buy for other people.

My car is costing even less than anticipated this year! I walk to work now. Of the $830 I spent, $200 was reimbursed by my employer, so I’ve only spent $630 out of pocket for gas and minor car maintenance. House and car insurance are expensive, though. I don’t track Rom’s car and bus costs as part of the budget.

I have spent a shocking amount of money on clothes so far this year, more than double what I intended. But I am buying items that are built to last, like a new rain suit for walking to work, and I am cutting back on other areas, so I don’t plan to stop spending on clothes for the rest of the year.

After a full tally, I spent $394 on unbudgeted items in the first half of the year, but I am only $49 overspent on my total budget due to savings elsewhere.

I am all too aware of how fortunate I am to have this much money to play with. I’ve marked the areas that are completely discretionary, and of course I could economize much more if I had to, so I am not worried about a financial disaster.

I thought I would publish this as a post-child rearing, pre-retirement snapshot!

In Canadian dollars:

| Expenses

(Discretionary in green text) |

YTD Budget 30/06/14 | YTD Actuals 30/06/14 | Underspent or Overspent | % of Actuals | Note |

| House Improvements | 8950 | 8950 | 0 | 25.4% | Heat pump system and hot water tank |

| Long Term Savings | 6000 | 6000 | 0 | 17% | Retirement savings |

| Grocery | 2940 | 2873 | -67 | 8.2% | Meals, snacks, cleaning, personal care |

| Gifts | 2450 | 2047 | -403 | 5.8% | Includes savings for gifts later in year |

| Vacation Savings | 2360 | 2360 | 0 | 6.7% | Still have savings from 2013 as well |

| Power, Heat, Water | 1890 | 2072 | 182 | 5.9% | |

| Home Repair Savings | 1410 | 965 | -445 | 2.7% | Spent some from this account |

| Insurance Savings | 1350 | 1350 | 0 | 3.8% | Savings 2/3 complete for annual payment |

| Property Tax | 1200 | 1126 | -74 | 3.2% | Half of annual cost |

| Car | 1170 | 830 | -340 | 2.4% | Gas, routine maintenance |

| Internet/Cable/Phone | 990 | 995 | 5 | 2.8% | aka “other entertainment budget” |

| Entertainment | 960 | 1001 | 41 | 2.8% | Dining, cafes, concerts, plays, movies |

| Charity | 900 | 840 | -60 | 2.4% | Paid to date |

| Clothes | 450 | 1101 | 651 | 3.1% | Will post about this separately |

| House Repair/Maint | 450 | 769 | 319 | 2.2% | Boiler repair, power washer |

| House Misc | 390 | 283 | -107 | 0.8% | Budget 65/month |

| Charity Savings | 240 | 240 | 0 | 0.7% | Towards annual gifts to pay at year end |

| Job Expense | 240 | 200 | -40 | 0.6% | |

| Registration fees | 235 | 235 | 0 | 0.7% | Passport, Costco membership |

| Pets | 180 | 199 | 19 | 0.6% | Cat food and litter |

| Computer | 120 | 151 | 31 | 0.4% | Blog domain, printer ink, etc |

| Hair | 120 | 60 | -60 | 0.2% | Letting hair grow a bit! |

| Cell phone | 105 | 109 | 4 | 0.3% | |

| Health | 60 | 59 | -1 | 0.2% | |

| Unaccounted for | 0 | 40 | 40 | 0.1% | Should be zero! |

| Fitness | 0 | 145 | 145 | 0.4% | Skating helmet, skating |

| Book, CD, DVD, iTunes | 0 | 82 | 82 | 0.2% | Used to spend about 1200/yr on this! |

| Jewellery | 0 | 69 | 69 | 0.2% | Vacation shopping |

| Postage & stationery | 0 | 42 | 42 | 0.1% | |

| Bank charge | 0 | 16 | 16 | 0% | |

| $35,160 | $35,209 | $49 | 99.9% |

This isn’t the halfway point of the financial year for everyone, but how is your financial year shaping up?

You should consult with families over budgets teaching them how. You could help many.

Thanks, BTG! It has been a while since I’ve had money struggles so I might not be the most relate-able person.

You are so precise, so exacting, even! Lol.

Like you, we are scrimping splurgers. Yearly splurges include holidays, clothes, eating out and alcohol. We scrimp on cleaning products (partly an environmental concern) and groceries (I minimise waste and we cook a lot from home and from scratch). Unlike you, we still have a mortgage. Oh, I can’t wait for that shackle to be released!!!

My hair care would be a splurge. I get it coloured every 5 or 6 weeks. The price of beauty!

Utilities have risen beyond belief here so we were are turning the heating off earlier. It is actually a constant battle between Mr Sans and me. I turn the central heating off – too stuffy, can’t breathe as well as wanting to save money. Why spend money to be uncomfortable? Mr Sans turns it on. I turn it off when we go to work as the kids are still in bed and won’t notice it anyway. The kids laugh at our battle, “Who touched the thermostat?” Think it is from Family Guy or The Simpsons or some TV show.

But other than ensuring we can pay our bills, we don’t really budget. We just cut back on splurges when we have to pay a bill or want to pay off more. Eg at the moment I am paying extra on our mortgage so I tightened up on groceries and clothes and going out.

What’s the difference between old oil and new oil? Are they both style of diesel?

I do the same for groceries – mostly eat at home and hate waste! I used to get my hair coloured monthly but when it needed doing more often than that, I gave up 🙂 On the heating costs graph, old and new oil mean an old oil furnace/boiler or a new/efficient oil furnace/boiler. Mine is newer. I was always the same as you – up until about 8 years ago, I checked my spending and made sure I had enough cash flow to cover bills, but I didn’t really budget. Given how much I move money around within my budget (to cover clothes this year, for example), I’m not sure I’ve changed that much, but I am now diligent about setting aside savings first.

As someone who has been managing my own money / paying for all of my expenses myself for only about a year, these kinds of posts are really interesting to me! I also love your precision/diligence in recording your spending – very similar to my own methods 😉 My one question would be how do you create your budget plan? Do you allocate a certain percentage of every paycheck to each category or do you have a set amount per month in mind based on previous years / experience? I hope that’s not too nosy a question, I’m just starting to figure these things out for myself and I’m curious as to what other people do! 🙂

Not at all – I do have a set amount in mind from past experience, and then I save towards all of my annual bills. Here are a couple of posts about it:

https://anexactinglife.com/2013/08/27/money-tracking-the-exacting-way/

https://anexactinglife.com/2012/09/22/budgeting-for-the-blips/

Okay thanks I’ll check those out!

We track our expenses every year and every year we have gaping holes which we can’t account for. We obviously spend far more than we record, but I figure at least we make an attempt. We live well below our means so it isn’t a big issue, but I still like to have some idea of where all the money goes. I don’t consider our lifestyle lavish by any means, but it is shocking how much money we spend – which is probably an indicator of how privileged we are.

The usual suspects for “gaping holes” are restaurants, cafes, take-out coffee, stopping by the grocery store for “a few things,” snacks and gifts at work, buying stuff for fundraisers, handouts to kids, etc! I’ve lost track of how many people tell me their families spend about $100 a week on groceries – but that is only the one main trip, and not the top-ups or the fast food or the Friday night pizzas. It really is easy to lose track, especially with cash. But if you are spending your money on food and experiences, and are not surrounded by stuff (and I know you’re not), then I bet you are doing better than most!

It’s always fun to see how you spend your money. 🙂 I hope the new heating system saves you a lot! Do you think you’ll use the AC much? Ours is broken, but thankfully there have only been 3 uncomfortably hot days so far this summer (and it should be fixed next week).

I think I remember you saying part of your pay is taken for a pension fund. Is the “retirement savings” line separate from that?

Your cats are much cheaper than mine 🙂 Plus mine have recently developed a taste for fancy cat litter. (I had to buy it because the store was out of our normal brand, and now they refuse to use the litter box with the old style litter in it, even when it’s fresh, haha.)

We are used to not having AC. We usually have about 2-3 weeks each summer where we wish we had it. But we’ll be able to run it in dehumidify mode even if we don’t run the cooling. I think that will help a lot.

Yes, our pension deductions have gone up to 11.96% this year (!!) and I am saving extra because I only started my current job at age 40. According to the formula, I will be eligible for a 50% pension at age 65. Since I am already mortgage-free, my expenses won’t change much when I am 65, so I will need a lot of savings to top up the pension. Also I was out of Canada for a few years so I won’t get full govt benefits either.

We have the pine cat litter at our house; I find it doesn’t need to be swapped out quite so often!

OK… here’s what pops out at me.

1) Canada has $2 coins?!? Who knew? Here in the US they haven’t even been able to make a dollar coin that would stick!

2) You only spend $33/month on your cats?!? Holy Moly! I’m down to 3 cats right now, but I easily spend over $200/month on them. Premium cat food at $2/can… natural cat litter at about $1/pound… pet insurance at about $20/month per cat. Omega 3 supplements, kitty probiotics, and dehydrated chicken and liver treats… extra electricity for Princess’ heating pad… Hmm…. guess we know who’s in charge at my house! 🙂

3) $10/month on health care?!? I guess that’s what a real national health care system looks like. I’ve already spent $1300 on premiums and that’s for a $5000 deductible policy! I’ll get a big tax credit at the end of the year but still…

4) KUDOS on your new heat pump! I installed one a few years ago and it’s wonderful. I fear I don’t save that much money because I pay a very high price for electricity in order to get it all from wind power – but that’s just green guilt. I could be paying much less as it is very efficient. Anyhow, you might want to keep an eye on it when the temperatures start to fall and make sure that it’s switching over to the backup heat source when you want it to. The guys who installed mine didn’t understand the thermostat, and they had it set so it NEVER went to the actual furnace… even when it was below zero F outside! I couldn’t get any help from them or the manufacturer, but I finally found someone online who sent me the installer’s manual (as opposed to the meaningless user’s manual that they gave me.) Anyhow, the manual had the secret codes which let me get into the “off-limits” controls to adjust those settings.

Yeah, our cats really are cheap! Last year $600 total including a kennel stay. They have been eating grocery store cat food (various brands) since they were kittens and the vet is pleased with their health and weight so I haven’t switched up.

I am looking forward to seeing how the heat pump system works out. I know the owner of the company that installed it, so we’re pretty much guaranteed good service (or else they won’t be invited to our Christmas Eve parties any more, LOL!)

I didn’t know about secret settings on appliances until we bought a DVD player and were able to re-program the country codes on it so it will play both PAL and NTSC discs!

I love how you have laid this out, it is really useful!

I wouldn’t want to post this every month because the budget averages out better over 6 months 🙂

It’s always fun to see other people’s budgets and it looks like yours is solid! How excited are you for your NYC trip!!? I can definitely provide any assistance you need with looking over an itinerary or answering questions. It’s a huge place!

Thanks! Can hardly wait, but I have lots of research to do, or rather, setting aside time to remember things I’ve heard of and want to try!

This year I’ve been recording my expenses (just mine, not all of the household expenses, as my bf is in charge of those, being the homeowner). I’ve never recorded them properly before. I set up a rough budget, although having no previous records of expenses it was a bit if a guess!

I’m pleased that I have stuck to recording expenses, and also that so far I have not dipped into savings, as I have not spent more than my income each month. Also, I have set up an automatic transfer to savings each month, and have therefore been able to add over £1000 this year so far. As I don’t have a decent pension, savings are good!!

Wow, for someone new to budgeting and saving, you are doing fantastic! It takes most people years to get that far, especially the self-discipline part.

I am impressed by your ability to keep track! I do track food/fuel/clothes/healthcare and a few other things and have records of this for years in preparation for my husband to semiretire, as I already have. I will second the great fortune you have in healthcare; our premium will be over $1000. per month with a $5000. deductable. Per person. So you need $20 grand in the budget for this if you have no subsidies under the current madness.

When I lived in the US I had an opportunity to go on a COBRA plan after leaving a job and it would have been $900/month, and that was 15 years ago.

Last year I paid $2600 for supplementary health insurance but also received an employer credit for $2200 of that so the net was $400 (for the year).

Like others have said, I’m awed at your exacting ways!

Recently I’ve felt my money is getting away from me, and have drafted a post about an ambitious savings goal, seeing that’s how I ‘budget’ – I save first, spend later. Admittedly, I have a ‘bills’ amount saved, as well as a ‘charity’, ‘holiday’ and a ‘dream’ fund, so in essence, I have most things covered. I just feel between paying for my trip, the short jaunt to the half marathon, a fancy meals out and some clothing and shoes, it’s getting carried away.

However when I look at month on month, I have more and more saved (even after the bills come out which can be a jolt quarterly), so perhaps I shouldn’t beat myself up. I don’t have the stamina to note every expense, mainly cause I know I always spend less than I earn.

Hi Sarah, I think if you have your bills and savings covered, you’re already doing great! I have certain months with lots of spending on travel and clothes and entertainment, and some with none, so I know it will balance out over 6 months or a year.

Yes we will do COBRA for the rest of the calendar year to take advantage of our deductable, but that will be $1475/month. Holy Crap!!

!!

Pingback: Minimal Wardrobe, Maximal Cost | An Exacting Life

Pingback: Summer Updates: Loss + Babies + Hedwig + Veruca Salt